A credit report is much more than a document; it’s a reflection of your financial journey, detailing every step, misstep, and achievement along your path.

A credit report is a record of your credit history, showcasing a record of your payments and outstanding debts from various credit institutions, including retail banks like DBS, UOB, and OCBC, as well as other financial institutions.

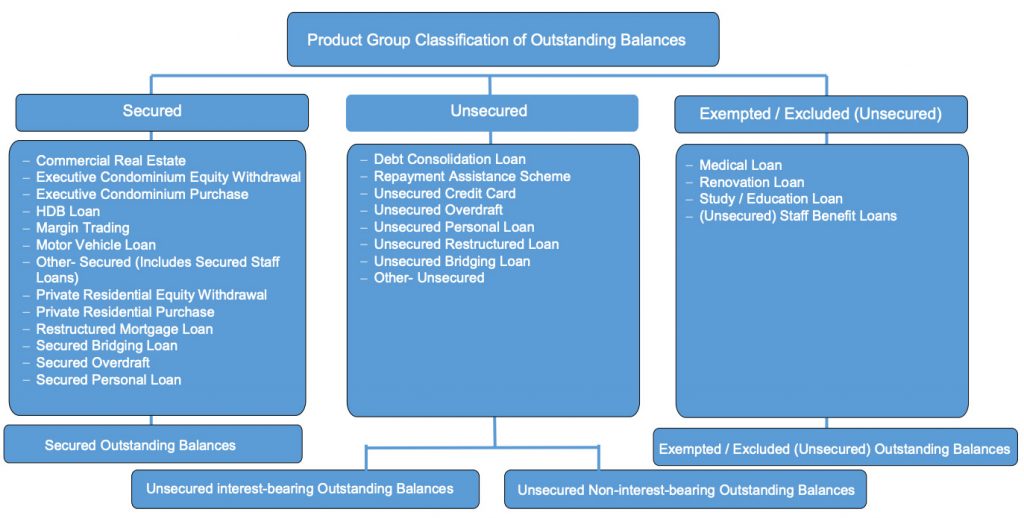

The credit report data includes credit cards, home loans, car loans, mortgage loans, and personal loans. Here’s a chart:

They are compiled by different credit providers who are contributing members of Credit Bureau Singapore (CBS). You can view the list of members here.

What is a Credit Score and why is a Credit Score important to track?

Your credit score is like a financial health checkup, summarising down your credit activities into a single number. This score is crucial because it predicts how likely you are to repay your debts.

Fundamentally, the credit score represents your creditworthiness and serves as an estimate of the likelihood that you will repay a loan successfully.

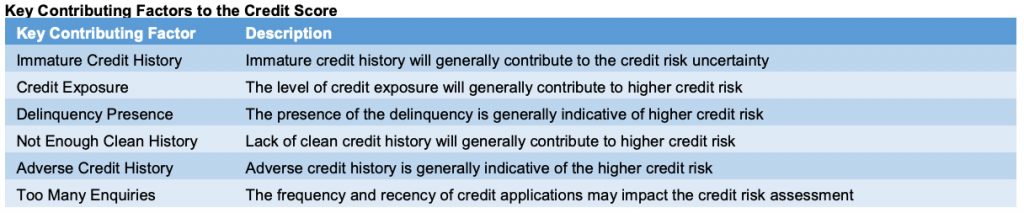

Key contributing factors to your credit score:

If you have outstanding debts such as a credit card bill, and you did not make payment (whether minimum payment or full payment), the record will show in the credit report which may affect your credit score.

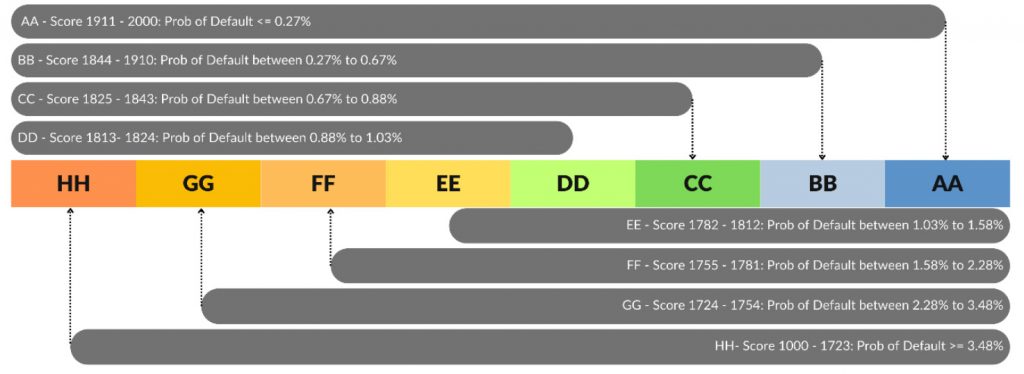

The credit score is typically a range of values between 1000 to 2000 with grading AA to HH where

- individuals who score at the lower end of the range are more likely to default on a payment

- those who score at the higher end of the range are less likely to miss a payment or default, and are more reliable borrowers.

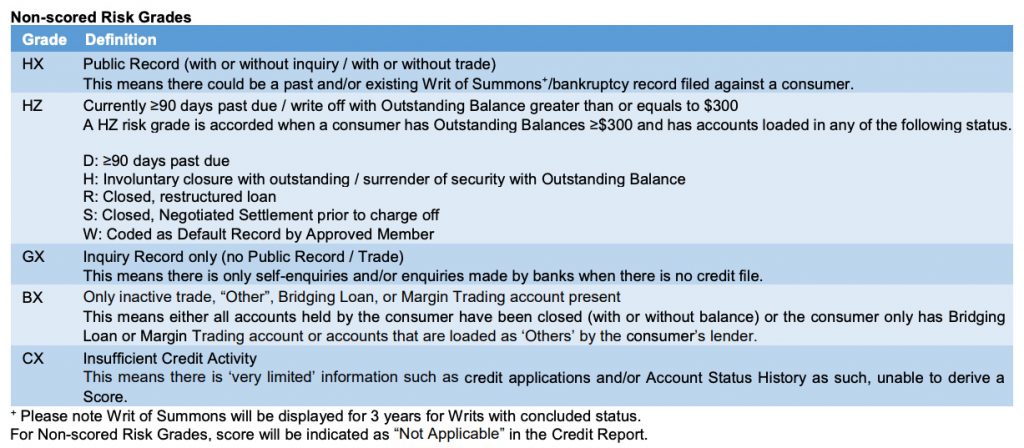

There are certain circumstances where your score may not be in the 1000 to 2000 range. These can be because of a variety of reasons:

A bad credit score or rating can mean outright rejection by the banks or financial institutions even if you do pass the minimum income requirement thus it is important to track your credit score quarterly to ensure that you are on top of your payments.

Who uses the credit report?

Credit providers often consult the CBS credit report as part of their evaluation process when considering an individual for credit or loans. This report is one of the assessment that the providers conduct on top of their own internal credit checking policy to form a comprehensive view of an applicant’s financial health.

The role of CBS is not to influence loan approvals directly; rather, it supplies lenders with objective credit information to aid in their decision-making, based on their own lending criteria and risk tolerance.

Additionally, some employers might request a credit report as part of the job application process to gauge an applicant’s financial reliability. This practice isn’t limited to new hires; it can extend to periodic checks on current employees to ensure they remain financially stable, especially in roles within the public sector or financial and banking industries where financial integrity is crucial.

How to obtain your Credit Score in Singapore

To access your credit score, you can request a credit report from the Credit Bureau Singapore (CBS). You have two options:

- request a soft copy online at CBS, or,

- obtain a hard copy at select SingPost outlets, the CBS office, or CrimsonLogic Service Bureaus.

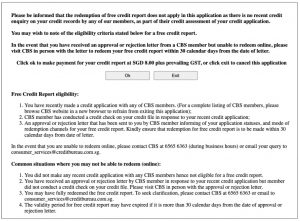

Obtaining a credit report in Singapore incurs a cost of S$8 (excluding GST), plus potential extra fees for specific delivery options. However, if you’ve recently applied for credit through a CBS member institution, you can access your credit report at no charge.

Step by Step Guide to obtaining your Credit Report in Singapore

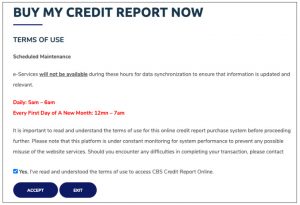

- Navigate to the CBS link here.

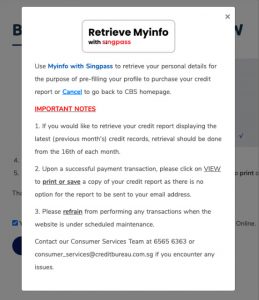

- Retrieve your personal details with Singpass.

- Click ‘Next’

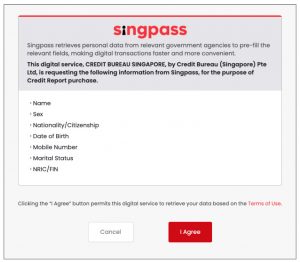

- Login with Singpass

- Authorise with the Singpass app

- CBS will extract the following information from Singpass

- Some information have been filled up for you. Input the blanks. Fields with the asterisk (*) are mandatory.

- Click ‘OK’

- Click ‘Confirm’

- You will need to make payment for the credit report. Click ‘Proceed’ to go to the payment page.

- Input your credit or debit card details to make payment.

- Once payment is successful, you will be redirected to the receipt page. Click on ‘View / Submit’ button to view your credit report.

- The Credit Report will be shown on your screen. You can Print or Save your report to your device.

How to read your Credit Report in Singapore?

Account Status History

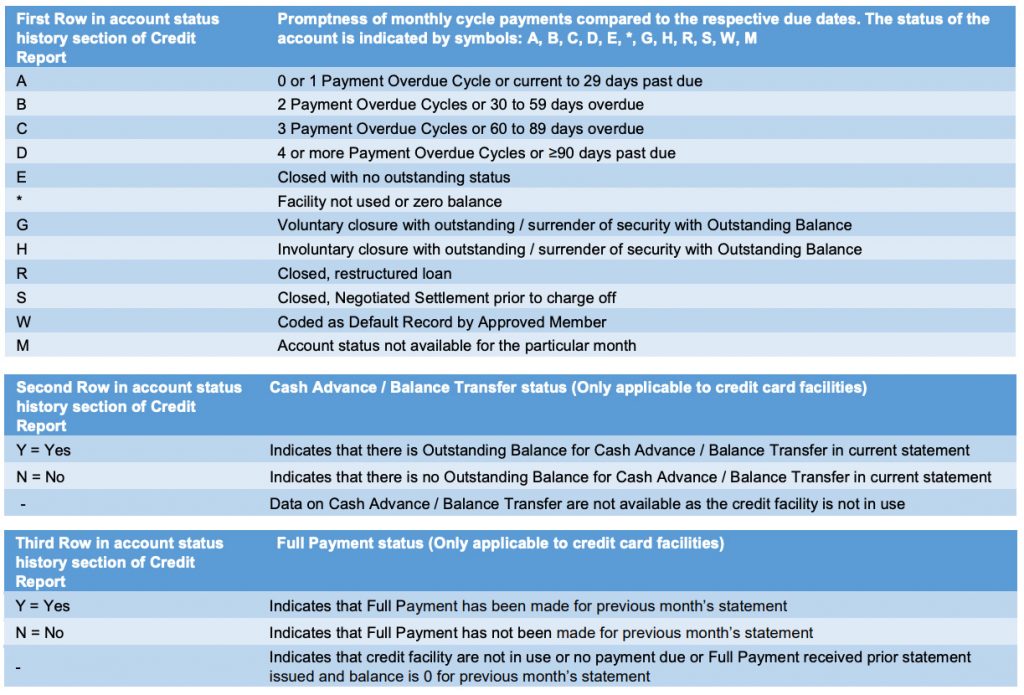

Each debt facility will have a column detailing your account status in a rolling 12-month basis. There are three rows with varying indicators:

Available credit

This reflects how many credit accounts you have open. Holding several lines of credit can negatively impact your credit score.

Recent credit

Spreading out new credit applications is advisable. Frequent applications in a short period might suggest financial strain.

Enquiry activity

Each loan application triggers a credit inquiry. Too many inquiries can lower your credit score, implying a higher debt risk. Aim to limit new credit applications.

Utilisation pattern

This shows how much credit you’re using relative to your limits. High utilisation can signal a heavy debt load, potentially lowering your score.

Account delinquency data

Missing payments can decrease your credit score, signalling overspending and a risk of debt.

Credit account history

A consistent record of on-time payments can boost your credit score, unlike a sparse or non-existent payment history.

You can view the CBS PDF guide on how to read your credit report here.

How does a person’s credit score affect their loan eligibility?

A person’s credit score plays a crucial role in the loan application process, influencing both the loan’s terms and its approval.

Individuals with superior credit scores often secure loans with more favorable interest rates. Conversely, those with lower scores may face rejection or receive loans under stricter conditions and higher rates.

For instance, Standard Chartered Bank employs specific “cut-off” or baseline scores in their decision-making process. Applicants falling below this threshold are typically denied, whereas those surpassing it may be approved, provided they satisfy further criteria related to affordability and verification.

This “cut-off” score is determined to align with the bank’s willingness to take on risk, ensuring they only extend credit to borrowers fitting their criteria for a particular financial product.

How long does information remain on your credit report?

The type of information on your credit report affects your perceived creditworthiness differently.

Repayment history is updated every 12 months, meaning you can improve your payment track record within a year by making timely payments.

Credit inquiries are kept for two years, while settled defaults are noted for three years. Unresolved or partially paid defaults remain on the report without a set expiry.

The credit report maintains information to aid in evaluating creditworthiness as follows:

- Inquiry details stay on the report for two years from the date of inquiry.

- The history of timely payments is updated continuously on a 12-month cycle.

- The payment history of closed accounts is available for three years from the account’s closing date.

- Defaults settled through negotiation or in full are recorded for three years post-settlement.

- Defaults remaining unresolved or partially paid are kept on the report indefinitely.

- Bankruptcy information, if relevant, stays visible for five years post-discharge.

Improving your credit score in Singapore

Maintain Credit Limits

Ensure you use your existing credit facilities wisely by not maxing out your credit cards. High utilisation can negatively impact your score.

Avoid paying only the minimum sum

Regularly paying only the minimum due can lead to accumulating interest. To avoid this and potential negative impacts on your credit score, try to settle the full balance each month.

Limit New Credit Applications

Frequently applying for new credit can make you appear desperate for credit, potentially raising red flags with lenders.

Remember, lenders consider your credit score among other factors such as income, job stability, and any legal proceedings, which influences their lending decisions and the interest rates offered.

Conclusion

This comprehensive guide on obtaining (and improving) your Credit Score in Singapore shows you that awareness and responsibility towards your credit report and score is important.

From securing favourable loan terms to impacting employment prospects, your credit report is the linchpin in your financial stability and growth.

By understanding how to access, interpret, and improve your credit report, you’re not merely managing numbers; you’re steering your financial future towards more promising horizons.

Remember, a proactive approach to maintaining and enhancing your credit score can unlock doors to financial opportunities and secure your financial well-being.

Whether you’re applying for a loan, seeking employment, or aiming to maintain financial health, your credit report is an indispensable tool in your financial toolkit.

Large outstanding debts? Seek advice from Debt Aid Singapore

If you have problems paying your outstanding debts, consider seeking help from Debt Aid Singapore under the Debt Repayment Scheme.

A Debt Repayment Scheme in Singapore gives the you the opportunity to repay your debt within a set timeframe at no additional interest charge levied, with the aim of settling your debt and potentially avoid bankruptcy.

In a Debt Repayment Scheme, eligible debtors will be afforded a monthly instalment payments of up to 5 years (length of time is as mandated by law in the Bankruptcy Act) to pay off their creditors. A court-appointed officer called the Official Assignee will assist in administering a suitable repayment plan.

At Debt Aid, we help you understand the processes involved end-to-end so you can fully make an informed decision about how to resolve your debt problems. You can also read Debt Aid’s 2024 Complete Guide to Debt Repayment Scheme in Singapore for more information.

The more you delay, the more the interest fees that your banks or financial institutions will charge. Your peace of mind starts with a simple consultancy appointment with Debt Aid Singapore.